Introduction

In recent years, digital currencies have gained widespread attention and popularity as a potential alternative to traditional fiat currencies. Digital currencies, also known as cryptocurrencies, are decentralized digital assets that are secured through cryptography and operate independently of a central bank. While Bitcoin, the first and most well-known cryptocurrency, was created in 2009, the rise of digital currencies has only accelerated in the last few years, with new coins and tokens being created at an unprecedented rate. This article explores the future of digital currencies, such as Bitcoin and Ethereum, which are based on blockchain technology.

The Benefits of Digital Currencies

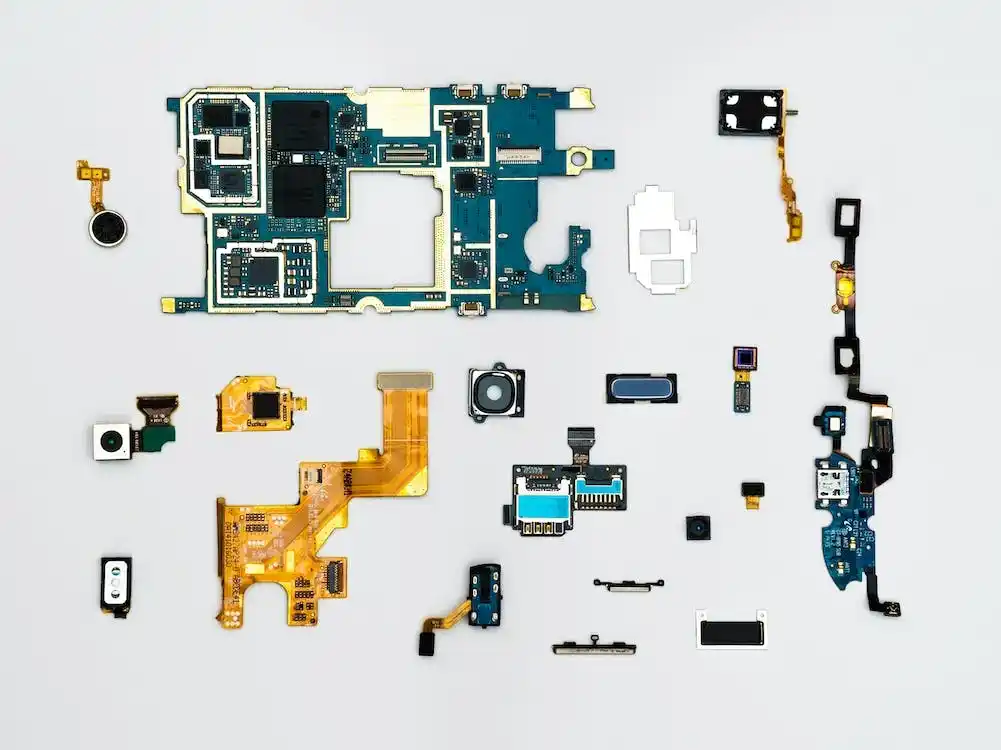

One of the main benefits of digital currencies is their potential to offer more secure and private transactions compared to traditional fiat currencies. Because digital currencies are based on blockchain technology, which is a decentralized ledger system, they are resistant to hacking and fraud. Additionally, digital currencies can provide greater anonymity and privacy for users, as transactions can be conducted without revealing personal information.

Digital currencies also have the potential to offer greater financial inclusion, particularly in developing countries where traditional banking systems may be inaccessible or expensive. Because digital currencies can be stored and transacted using a smartphone or computer, they can provide a low-cost and accessible alternative to traditional banking services.

Challenges Facing Digital Currencies

While digital currencies offer many potential benefits, they also face significant challenges that could hinder their widespread adoption. One major challenge is regulatory uncertainty, as many governments have yet to establish clear guidelines and regulations for digital currencies. This can lead to confusion and legal risks for businesses and individuals who wish to use digital currencies for transactions.

Another challenge is scalability, as many digital currencies currently have limited transaction processing capabilities compared to traditional payment systems. This can result in slow transaction times and high fees, which can be a barrier to adoption for businesses and consumers alike.

The Future of Digital Currencies

Despite these challenges, the future of digital currencies looks promising. Many experts predict that digital currencies will continue to gain acceptance and become more widely used in the coming years. Some even believe that digital currencies could eventually replace traditional fiat currencies as the primary means of conducting transactions.

One potential driver of this trend is the increasing adoption of blockchain technology, which underlies many digital currencies. As more businesses and organizations adopt blockchain for a variety of applications, it could help to drive greater adoption and acceptance of digital currencies as well.

Additionally, new technologies and innovations are emerging that could help to address some of the challenges facing digital currencies. For example, some digital currencies are exploring new consensus algorithms that could help to improve scalability and transaction processing times.

Conclusion

As the world becomes increasingly digital and interconnected, digital currencies are likely to play an increasingly important role in the global economy. While there are still many challenges that need to be addressed, the potential benefits of digital currencies make them an exciting and promising area of innovation and development.

As such, businesses and individuals should keep a close eye on developments in the digital currency space and consider how they may be able to leverage these technologies to improve their financial operations and transactions.

Best Articles

Read about Cryptocurrencies, Digital Dollars, and the Future of Money